Japan Medical Device Market

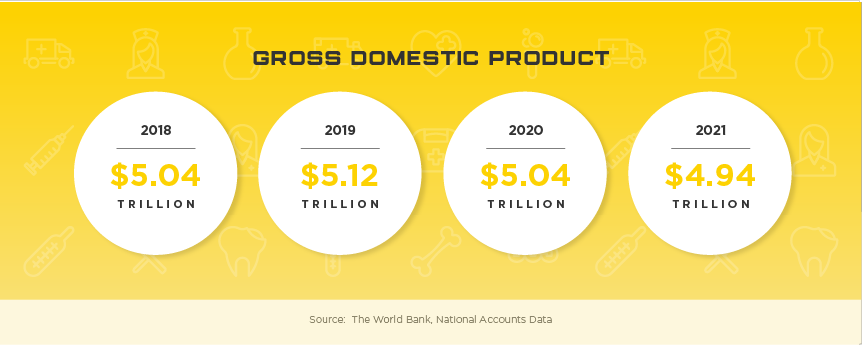

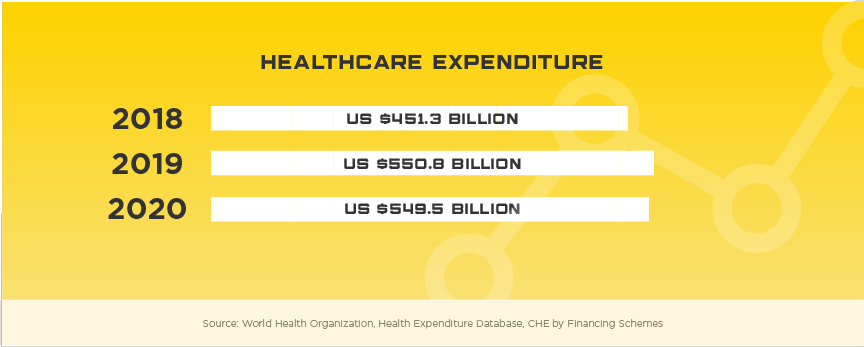

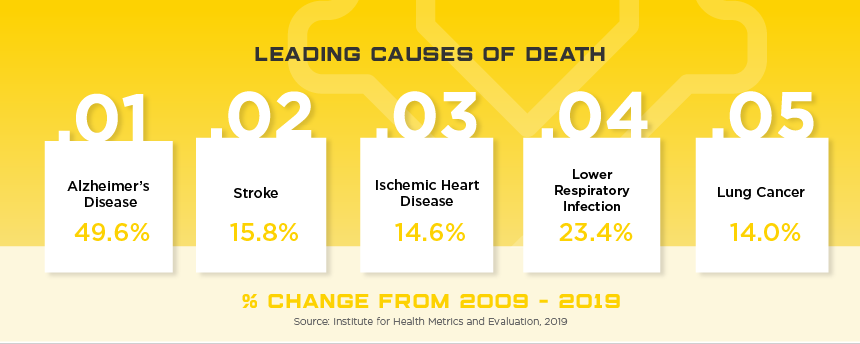

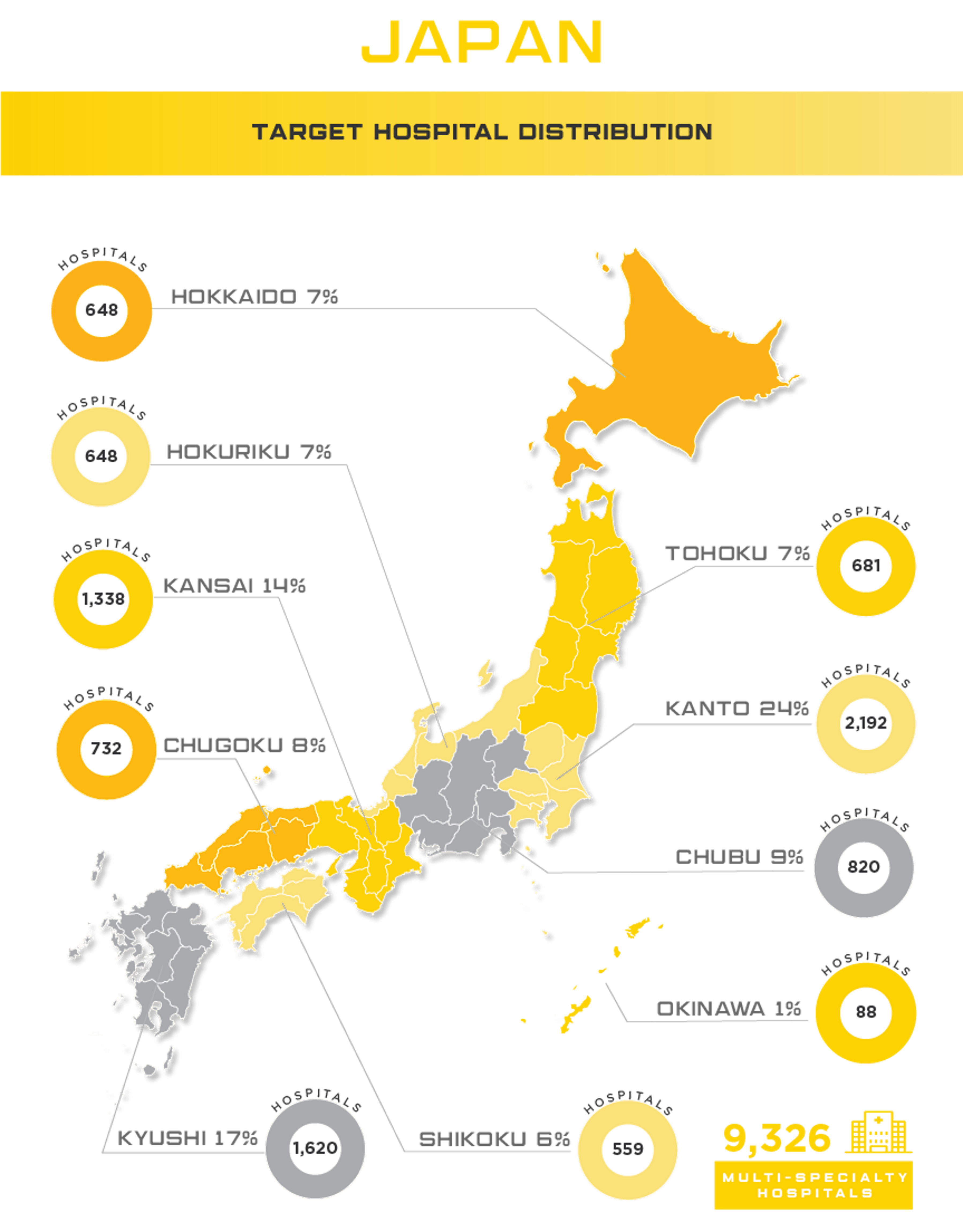

Boasting the reputation as the largest, most developed healthcare system in the region, Japan’s healthcare market poses numerous challenges to foreign medical device manufacturers. However, with expected growth of nearly 7% and current market value of $29.3 billion, medical device manufacturers can take their company to a new level with success in the Japanese market. With an aging population, high per capita income and incredible demand for high tech products, Japan is a market that needs to be considered for all medical device manufacturers looking for real growth in Asia. Other high potential specialty areas include self-care, preventative care, in-home care, health-IT devices, and advanced diagnostics that use AI to support evaluation and treatment options.

Worth noting is the highly developed Japanese market does have domestic companies that will pose challenges to some device sectors including: home therapeutic equipment, diagnostic imaging equipment, dialyzers, endoscopes and surgical equipment. Japan’s medical device industry is overseen by the Ministry of Health, Labour and Welfare (MHLW) and as in other markets, they have implemented mechanisms to help keep costs low, especially given their rapidly aging population. One of these mechanisms is that they use a robust reimbursement system that applies to all insurance plans, private or public. They’ve also implemented a Cost-Effectiveness Assessment (CEA) system and recently approved the 2018 Basic Policy on Economic and Fiscal Management and Reform, locally known as “honebuto,” to oversee welfare spending and make recommendations for improving the reimbursement system. Foreign medical device manufacturers are highly encouraged to research how their product will be evaluated and priced in the preliminary stages of market strategy planning.

Grow with us

Asia Actual is available to help navigate the complex medical device registration requirements and regulatory pathway for medical device and IVD distribution in Japan. Contact Asia Actual for a free consultation discussing the potential for your medical device or IVD in the Japan medical device market.

Important Documents and Links

Japan Regulatory Support

Bryan Gilburg

Contact Us

US: +1 512 898-9222 SG: +65 8800-3197 EMAIL: Japan@asiaactual.com

Latest Market Updates

Identifying Predicate Devices in India, Taiwan, China, Japan, and KoreaOctober 25, 2022 - 12:28 pm

Identifying Predicate Devices in India, Taiwan, China, Japan, and KoreaOctober 25, 2022 - 12:28 pm Medical Device Advertising Requirements in AsiaJuly 22, 2022 - 10:08 pm

Medical Device Advertising Requirements in AsiaJuly 22, 2022 - 10:08 pm Asia Actual is the Best Medical Device Consulting Company in AsiaFebruary 24, 2022 - 3:23 pm

Asia Actual is the Best Medical Device Consulting Company in AsiaFebruary 24, 2022 - 3:23 pm Medical Device Shipments During the COVID-19 PandemicJune 4, 2020 - 8:28 pm

Medical Device Shipments During the COVID-19 PandemicJune 4, 2020 - 8:28 pm 4 Product Development Decisions that Impact Sales Performance in AsiaOctober 2, 2019 - 6:51 pm

4 Product Development Decisions that Impact Sales Performance in AsiaOctober 2, 2019 - 6:51 pm

実際の亞洲

เอเชีย แอคชวล

एशिया वास्तविक

실제 아시아

Asia Actual, LLC

515 Congress Avenue, Suite 2100

Austin, TX 78701

+1 512 898-9222

Contact Us

Privacy Policy

Asia Headquarters

116 Changi Road, #04-05