Local Office

Tech Park, Sector-49,

Gurgaon 122018 Haryana, India

+91 (0124) 491-1981

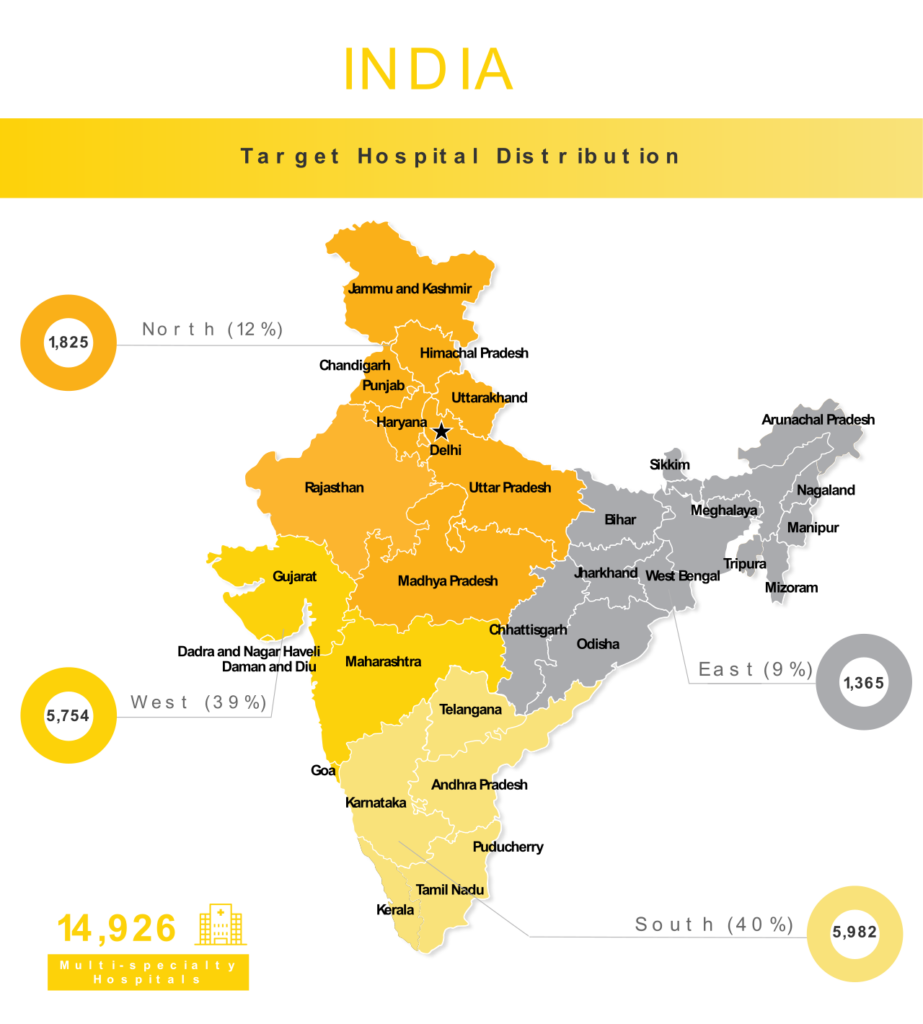

Surpassing China in year 2023, to be the world’s most populous country, India is a massive market offering tons of potential for medical device manufacturers. While the Indian government has launched numerous programs to try and support R&D investments in their country, India still imports 90% of all sophisticated devices they need. Currently, it is the 4th largest medical device market in Asia, with their market size expected to grow by ~28% to reach $50 billion by 2025. Most of this growth can be attributed to citizens’ rising disposable income and significant government investments in healthcare infrastructure throughout the country.

Medical devices are overseen by the Central Drugs Standard Control Organization (CDSCO) which was established under the Drugs and Cosmetics Act of 1940 to regulate the importation, manufacturing and distribution of drugs in the country. While India has approved several amendments to the original Act, India’s regulatory process remains fairly unsophisticated and instead, provides manufacturers with a specific list of device types that require registration.

A major shift in regulation of medical devices has been the transition from 01 October 2023, wherein ALL medical device, irrespective of notification status and risk class, are now requiring manufacturing, import, sales and distribution licenses with registrations with Central and/ or State Regulators in India.

These changes have been effected as amendments to the original Drugs and Cosmetics Act, 1940 and Rules, 1945 and the Medical Device Rules, 2017. While this expands the scope of regulatory coverage for medical devices in India, the basic regulatory process remains fairly unsophisticated. Previously, government gazette notifications provided manufacturers with a specific list of device types that require registration in India.

List of notified Medical Devices:

The medical device definition released in February 2020 initiated the phased regulation of all medical devices, effective from 01 October 2023, irrespective of their previous notification status. Subsequently, the Indian Regulatory authority has released indicative lists by therapeutic category for assistance on risk classification and further application.

Note: Seek guidance on application of categories. Information updated in December 2023. Learn more about the updated regulations here.

Asia Actual is available to help navigate the complex medical device registration requirements and regulatory pathway for medical device and IVD distribution in India.

Contact Asia Actual for a free consultation discussing the potential for your medical device or IVD in the India medical market.

US: +1 512 898-9222

SG: +65 8800-3197

EMAIL: India@asiaactual.com

Note: English version from page 143

実際の亞洲

เอเชีย แอคชวล

एशिया वास्तविक

실제 아시아

515 Congress Avenue, Suite 2100

Austin, TX 78701

+1 512 898-9222

Contact Us

Privacy Policy

116 Changi Road, #04-05